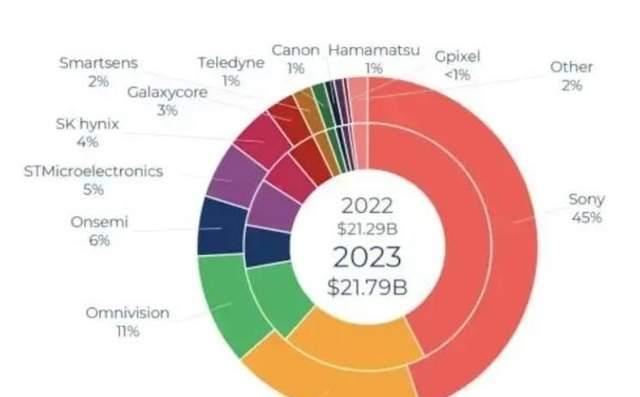

In terms of CMOS sensors, SONY ranks first, while Samsung, which has not been surpassed for many years, ranks second. As the chart below shows, by 2023, Sony's market share will reach 45% and Samsung's will be 19%, each accounting for 64% of the market, while in the domestic manufacturing sector, The top three companies are Howe at No. 3, Ge co Micro (Galaxy core) at No. 7, and Smart-sens at No. 8. But their combined share is just 18 per cent, less than Samsung alone and less than half that of SONY.

Aside from market share, in fact, most domestic CMOS sensors are the world of SONY, Samsung, etc., especially some SLR camera lenses, which are low-end and high-end products. However, recently, domestic CMOS chips have finally made a breakthrough: Local CMOS chip packaging and testing company Crystal Square and local CMOS chip manufacturer Stewart have jointly launched the first full-frame (2.77 inches) CIS (CMOS) image sensor with a resolution of 180 million pixels. This sensor is not designed for mobile phones, but is mainly used for high-end digital SLR cameras, and domestic CMOS has broken Sony's monopoly on full-frame, extremely high resolution CIS sensors for the first time. Another key technology in the production of such CMOS chips is lithographic bonding technology.What is lithographic bonding? In essence, it involves photo lithography. Since the photo mask cannot cover the entire chip, additional photo-masks are required. In this process, the circuit diagrams must be combined. During bonding, generally, accuracy issues arise, leading to reduced performance.

This time, Crystal Technologies and Strati x have jointly developed a lithographic bonding technology that addresses the bonding accuracy and performance issues of the pixel columns, so that the bonded chip still has consistency and compatibility of electrical and optical performance. At present, with the vigorous development of new high-performance vehicles, the revival of the mobile phone industry, and the development of various video devices, the CMOS market will continue to grow. In the past, CMOS sensors were monopolized by Japan and South Korea, and I hope that the domestic market can be more determined to introduce better and better CMOS chips to replace SONY, Samsung and other markets, so that Chinese manufacturers can avoid the neck with domestic CMOS chips and develop their own industrial chain.

At the same time, IT Home noted that domestic CMOS manufacturer Ste-way announced that in the third quarter of 2024, the company achieved CIS chip shipments of more than 100 million per month for the first time. This has also given many CMOS sensors and downstream industries confidence in future prospects. It is expected that domestic CMOS manufacturers can occupy more shares in the global market.